Choppy Conditions, China Trade War, TSM Earnings, BITF Parabolic Move.

$SPX battled all day to stay above its 20-day moving average (20MA) around 6674 after a huge gap up, but it failed to close above the level—hovering right at it in extremely choppy trading. At this point, we must keep our minds open to any outcome. The U.S.-China trade war is officially escalating, and the market is highly reactive to government posts and policy ideas.

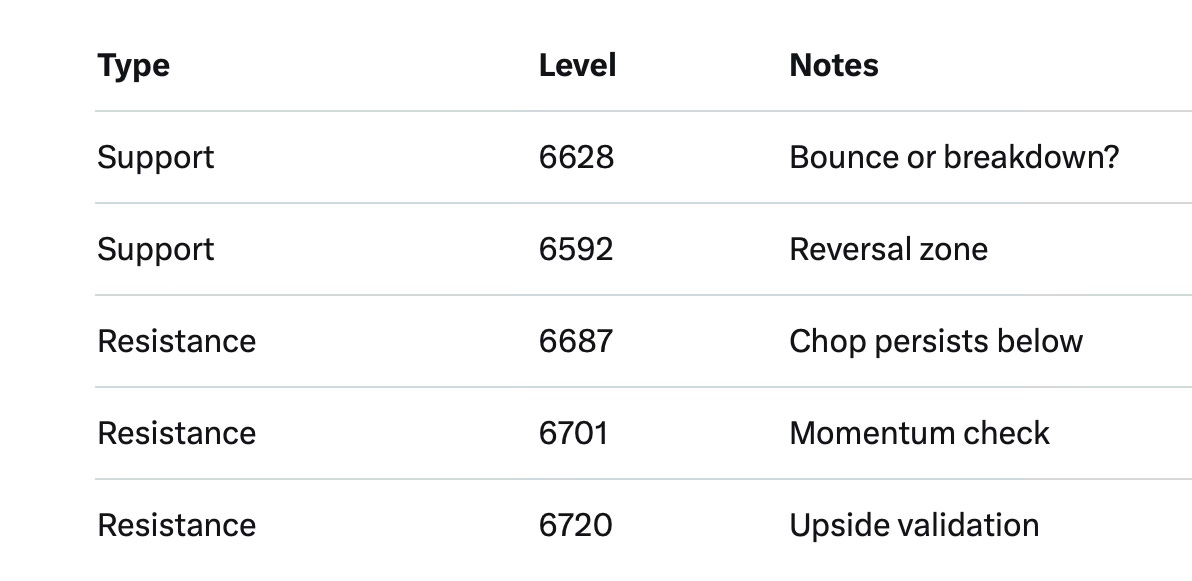

Key SPX Levels to Watch:

Resistance: 6,687 / 6,701 / 6720

Support: 6,628 then 6,592

TSM Earnings - October 16, 2025.

TSM 0.00%↑ (Taiwan Semiconductor Manufacturing Company Limited) Gamma Exposure (GEX) from Quant Data shows MMs are net long gamma (~+50M), creating a bullish, stability-driven environment. GEX Wall for this Friday’s OPEX is 310C (calls).