Commodities Report: Rising Volatility & Metals Flow

Option Flow Analysis With Proprietary Scanner

Hello Traders,

Friday’s CPI came in softer as expected, with inflation finally cooling to 2.4%. But instead of a victory lap, the bond market is flashing a warning sign. Yields are sliding as investors pivot to safety, worried that a cooling labor market and AI-driven disruption are finally starting to bite, especially in the financial sector. We previously flagged these risks in our bank analysis, and this data confirms why we are staying defensive for the rest of February.

XLF 0.00%↑ FINANCIAL SECTOR ETF broke below its 200 daily moving average, last time this happened was during last year’s drawdown.

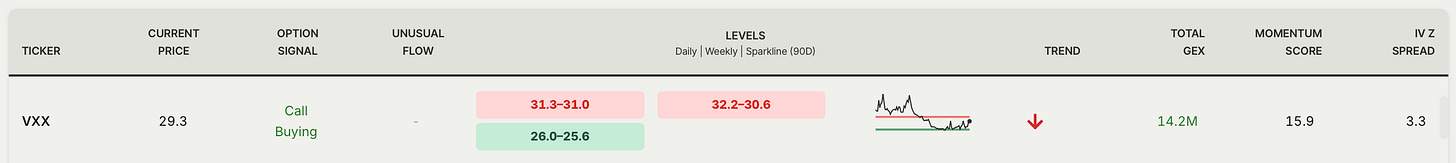

VOLATILITY ALERT

Institutional hedging spiked during Friday’s close! Hedge funds are aggressively rotating into long-volatility positions as a hedge against a weakening labor market and financial sector instability.

Our scanner just flagged something we rarely see: a Call skew spike with a 3.3 Z-score. This is a statistical 'outlier' event. It means the demand for upside calls has exploded so far beyond the 20-day average that it’s almost off the charts.

While the broader market braces for a volatility spike, the real story is shifting to the ‘hard assets.’ With geopolitical risks climbing, we’re seeing a major reshuffle in how big money is positioned across commodities and precious metals. Let’s look at who’s leading and who’s lagging as the tension heats up. We dive into Gold, Silver, Copper, Miners, Oil and Uranium.