Crypto Weekend Report: Why is Crypto Facing Such Weakness

BTC, ETH, SOL, IBIT, BITF, WGMI

Hi Traders,

The crypto market has retreated into bearish territory. Bitcoin (BTC) fell from a mid-week high of $98,000 to approximately $90,800 by January 20 as macro headwinds intensified. This risk-off sentiment was mirrored by a surge in the VIX above 20 and record highs in Japanese 40-year bond yields, sparking fears of a global liquidity squeeze.

We’re sitting right at a trendline and strong demand zone at 88.560. We preferably hold here to avoid lower prices. Next supply is 97,5k and then 107k.

The “Excess Fear Gap”: while equities remain near all-time highs supported by rising global liquidity, Bitcoin is pricing in a “premature top.” This creates a significant “Fear Gap” where BTC may be mispricing the cycle relative to other risk assets. There is a chance Bitcoin will catch up on the equities move.

ETHEREUM

Ethereum ETF Resilience: Despite the broader sell-off, Ethereum spot ETFs saw their strongest weekly inflows since October (~$479M). ETH prices held relatively firm ($3,100–$3,200) compared to Solana (-12%) and XRP (-20%).

Network Activity: Ethereum transactions hit a record 2.88 million daily, showing strong post-Fusaka upgrade utility.

Same like bitcoin, ETH is also sitting on a strong support now, needs to hold 2,880 level, otherwise next levels is 2,640. Supply levels are 3,247 and 3,456.

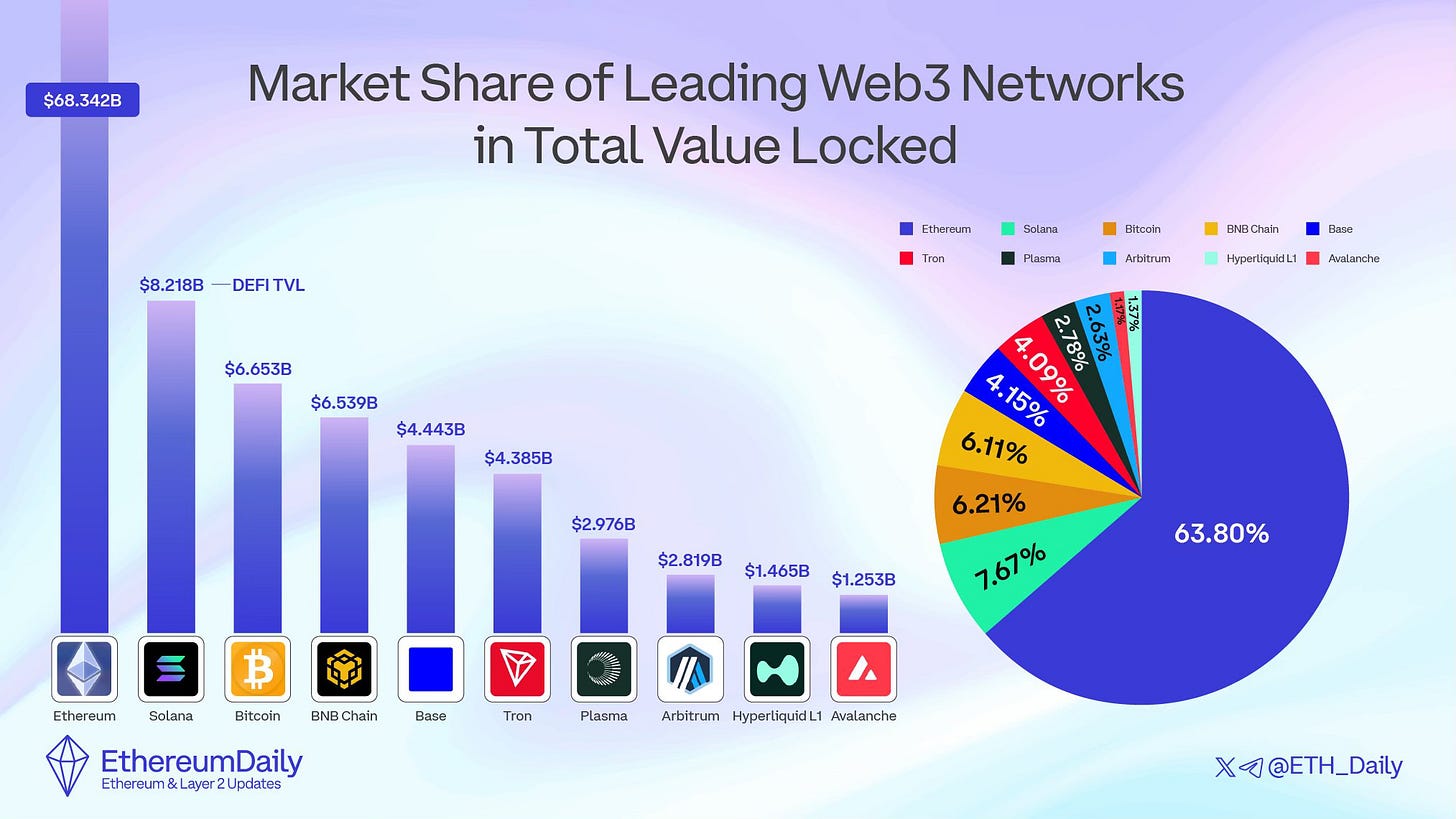

Web3 Network Dominance (TVL)

Ethereum remains the undisputed leader in DeFi, holding the lion’s share of capital. Competitors like Solana and Base are growing, but the gap remains vast.

On-chain Analysis: Solana’s Resurgence

Network Activity Hits 5-Month Highs

While price action remains defensive, Solana’s internal engine is humming. Weekly average Daily Active Users (DAU)recently clocked 2.7 million, a new “higher high” and the strongest level since August 2025.

Market Share: Solana now captures 13.5% of the total Layer-1 user base.

Adoption Drivers: This surge is fueled by lower fees, faster finality, and a growing Real-World Asset (RWA) ecosystem, which recently hit an All-Time High of $1.12B in TVL.

The Outlook: Historically, DAU stability above 2.5M precedes price momentum. Even in a “risk-off” world, Solana is outpacing Ethereum in relative user growth, signaling a potential rotation if macro conditions stabilize.

Solana chart the same story, close to demand zone.

Why is Crypto Facing Such Weakness?