Market Prep: 5 ETFs with best momentum, MSFT Deep Dive and NASDAQ Risk

Best Momentum Sectors & Trade Ideas

Hello Traders,

The Dow Jones finally hit the big 50,000 milestone, and the best part is how healthy it looks. We're seeing real momentum building as big money rotates out of over-crowded tech names and into the "real economy." Our scanner has been screaming about staples, transportation, packaging, and industrials past weeks! We hope you have all managed to diversify your portfolio by adding lower volatility names and made some good gains.

Volatility Warning

We’re staying cautious on software and big tech laggards because their debt problems are becoming a reality. While the market is pricing growth back in, that also means inflation expectations are creeping up, which keeps the Fed from cutting rates. This is bad news for tech companies that feasted on cheap money years ago and are now forced to refinance at today's much higher rates,

Companies with heavy maturities in 2026 and 2027 are under fire as bondholders head for the exits. Default risk is now front and center, justifying the recent volatility in some of the most widely-held retail names. If they can’t find a way to manage their liabilities without crushing their cash flow, the "restructuring cycle" is going to get very busy, very fast.

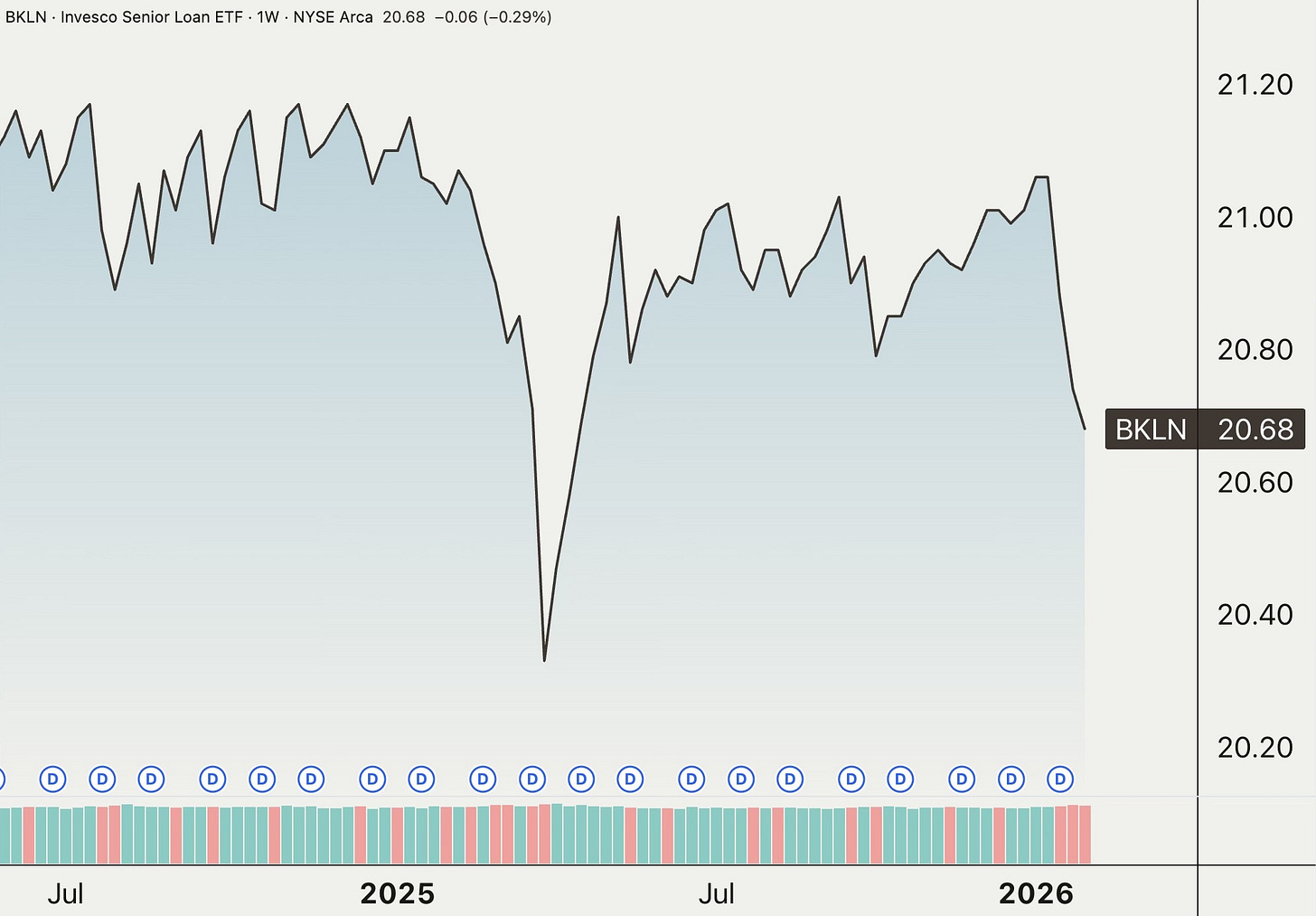

The BKLN 0.00%↑ senior loan ETF is reflecting current risk off mood between bondholders.

Now, let’s look at the names actually winning from this shift. Here are the specific stocks our scanner is flagging as the biggest beneficiaries of the current rotation.