Market Prep: February Seasonality - A Tale of Two Halves

Defensive Play in Rising Volatility

Hi Traders,

Welcome to February!

Historically, this month is a “split” month. It often begins with momentum but carries a reputation as one of the weakest months of the year on average.

The Early February Bounce: The first two weeks (roughly through Feb 16) are historically stronger. The S&P 500 has gained an average of 0.73% during this period over the last 50 years, with a positive frequency of 62%.

The Late February Fade: The second half of the month is where the “February Flinch” usually happens. Performance typically drops to an average loss of 0.75%, with only 42% of periods showing gains. This is often attributed to a “fundamental vacuum” once the bulk of Q4 earnings reports are released.

+1

The Mid-Term Factor: Since 2026 is a mid-term election year, seasonality is even more pronounced. Historically, the first half of mid-term years is characterized by “sideways-to-down” consolidation as the market digests policy uncertainty, often bottoming in the late summer before a major year-end rally.

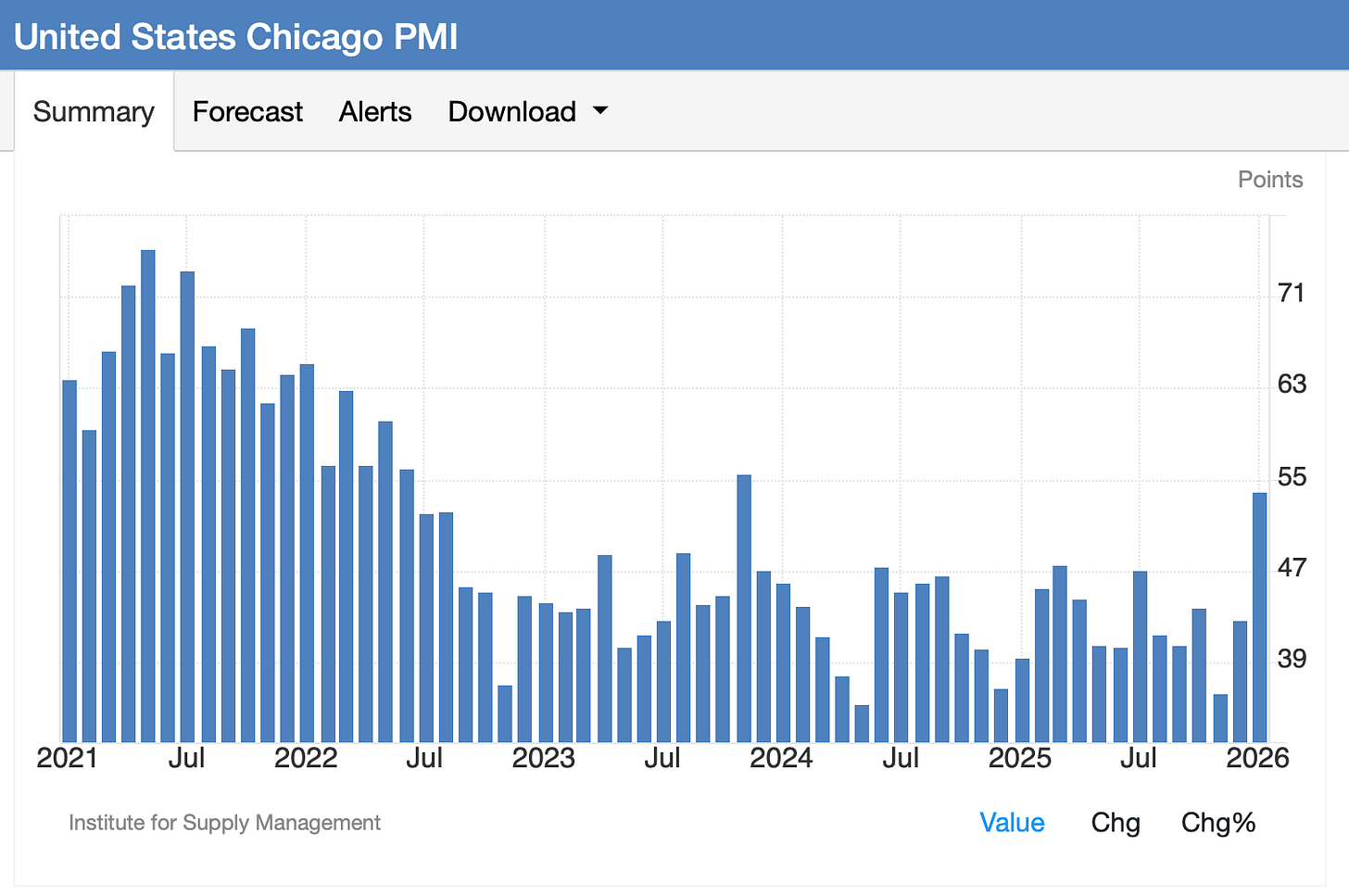

As of late January, a rare economic convergence has materialized: the Chicago PMI has shattered its 25-month contractionary streak with a surge to 54.0, colliding with a PPI print that significantly outpaced forecasts at +0.5% MoM.

This shift is a massive volatility catalyst, forcing institutional “Smart Money” to drop the “soft-landing” story. Instead, they are bracing for a “No Landing” scenario where the economy stays too hot, fueled by a US Dollar that spiked on Friday as the market realized rates aren’t coming down anytime soon.

For the disciplined trader, this isn’t just “risk”—it’s the start of a massive sector rotation. While the main indices struggle against a strong Dollar, big money is aggressively moving into new areas to profit from this regime.

Here is the high-conviction playbook institutional investors are using to navigate this rotation, based on our latest data: