Market Prep: NFP & VIX Term Structure

Institutional flow analysis with our proprietary scanner

Hello Traders,

Tomorrow’s NFP report is the ultimate check-up for Main Street. Speculation is already mounting that we’ll see a weaker-than-expected number, especially with job openings continuing to dry up.

This isn't just another monthly update; the BLS is about to go back and rewrite the history of the last year. Powell is already bracing for a downward revision of 60,000 jobs per month, treat that as your line in the sand. While the market ignored these tweaks in the past, the FOMC has been sounding the alarm on labor weakness for months, and tomorrow’s data could finally prove they were right to worry.

Let’s dive straight into how the market is bracing for the news.

THE VIX TERM STRUCTURE

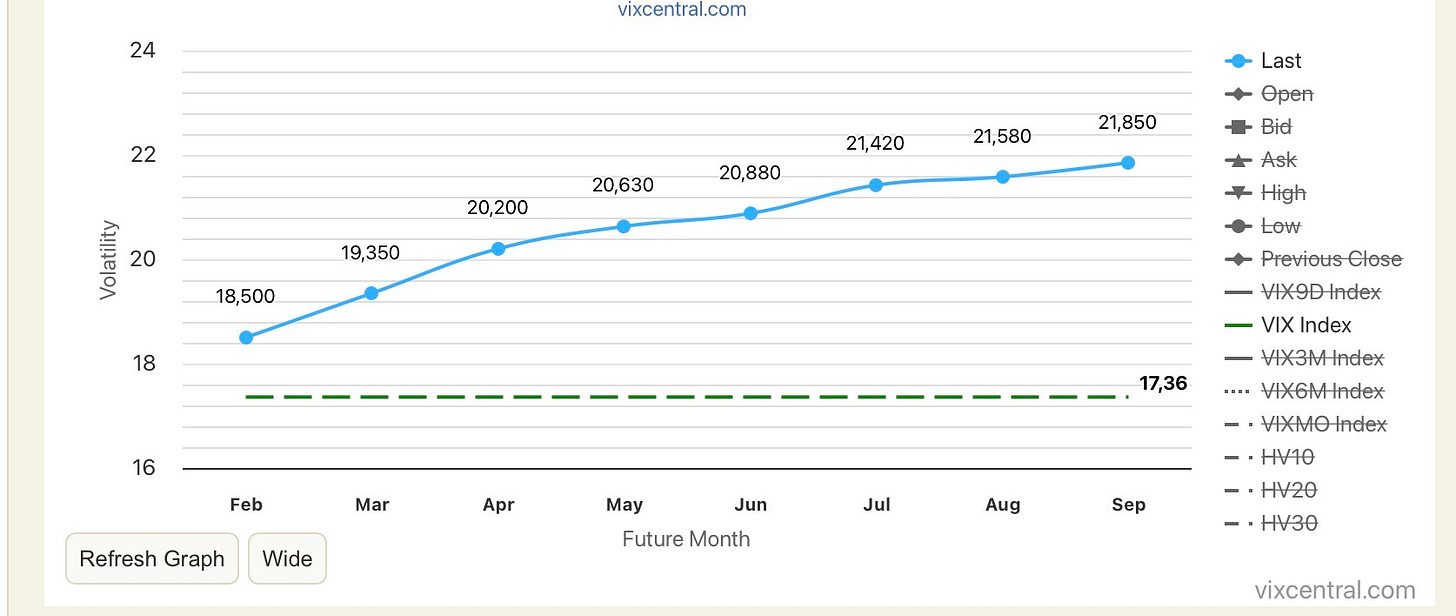

Traders’ sentiment is clearly visible in the VIX futures curve, which currently sits in a healthy state of Contango. This upward-sloping curve shows that premium is higher for the long term than the front month, signaling that the current expected moves are well within the norm. In this environment, market makers aren’t forced to hedge their books aggressively, so we can expect them to keep the price pinned within the current range until a new catalyst breaks the curve.

In a low-IV regime, downward moves lack the ‘fuel’ to turn into full-blown corrections. Because the market is pricing in stability, any spike in fear is seen as temporary, triggering mechanical buying from both algorithms and retail traders. This keeps drawdowns shallow and short-lived, as the ‘buy the dip’ crowd remains confident that the path of least resistance is still higher.

Top picks from our scanner and trades we took today: