Market Prep: Overbought Market, UVXY Setup & Long-Term QE Winners

$GGAL $BMA $FRDM $SDS $QID $SPX

Hi Traders,

Incredible week: several of our holdings rose 30–40% (CIFR, BITF) while the SPX gained over 4.5%. VSCO up over 12%, SLV flew on Friday also.

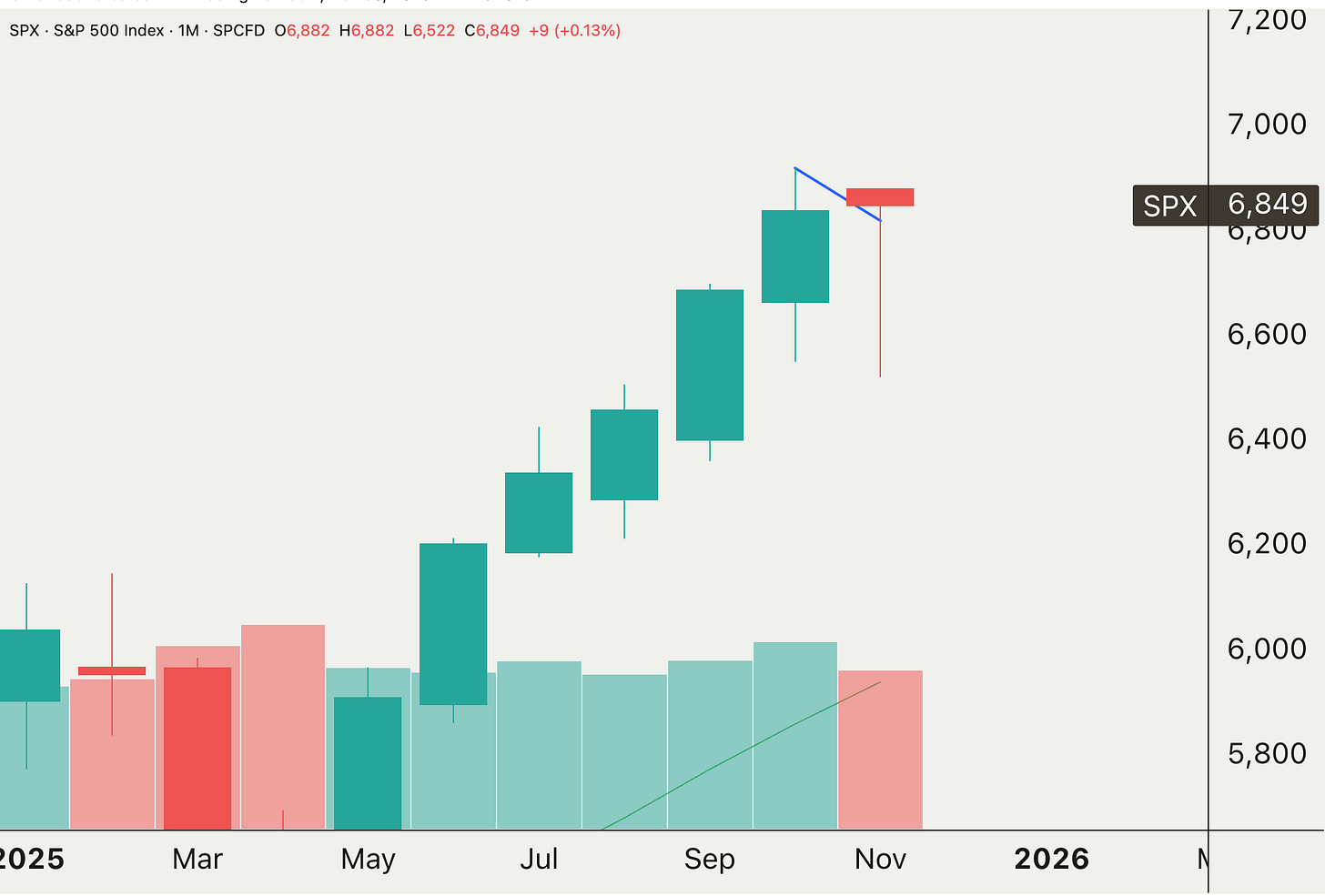

But we’re at a key inflection point 6,849. We still need to clear the November 12 high to avoid a lower high. A minor pullback to the demand zones below would be healthy, but staying above the critical long-term inflection point at 6,633 is essential.

Overhead, we face supply at 6,890; breaking that would confirm a clear uptrend and higher level at 6,955. With the FOMC rate decision in two weeks (currently 87.4% probability of a 25 bps cut), we expect no major sell-off—just a technical retest before the next leg higher. Doesn’t need to happen but would be healthy.

Everyone on X is buzzing about the “Hanging Man / Hammer” candle on the monthly chart without knowing the difference. Quick clarification: a Hammer and a Hanging Man look identical — the difference is where they appear. A Hammer sits at the bottom of a downtrend (think “hammer hitting the floor”), while a Hanging Man shows up at the top (grim but memorable). A red Hanging Man carries more bearish weight than a green one, yet single-candle signals still need confirmation — we could easily rally another couple of months before any real reversal, just like we’ve seen in the past. Bottom line: interesting to watch, but we’re not making portfolio decisions off one candle. Just something to keep in the back of our minds.

UVXY 0.00%↑ is very low and there’s not much fear in the market. Looking at this chart we could retest up towards the $51 level and market would inversely go down. So pay attention to this chart also and if you see a break of the trendline and UVXY going higher, then we play defense.

What’s Next? For now, avoid excessive longs and leverage; trail stop just in case and let the market confirm the uptrend first.

Our Picks for Quantitative Easing Plays

We’d like to look at some interesting trades — ETFs and individual stocks that will benefit greatly from a Fed easing cycle — plus one name we recently added to our longer-term (3–5 year) portfolio. A Fed easing cycle typically boosts rate-sensitive areas by lowering borrowing costs, encouraging economic activity, and supporting higher valuations.