Market Prep: Software Stocks & Smart Flow

Option flow analysis though sectors ETFs

Hello Traders,

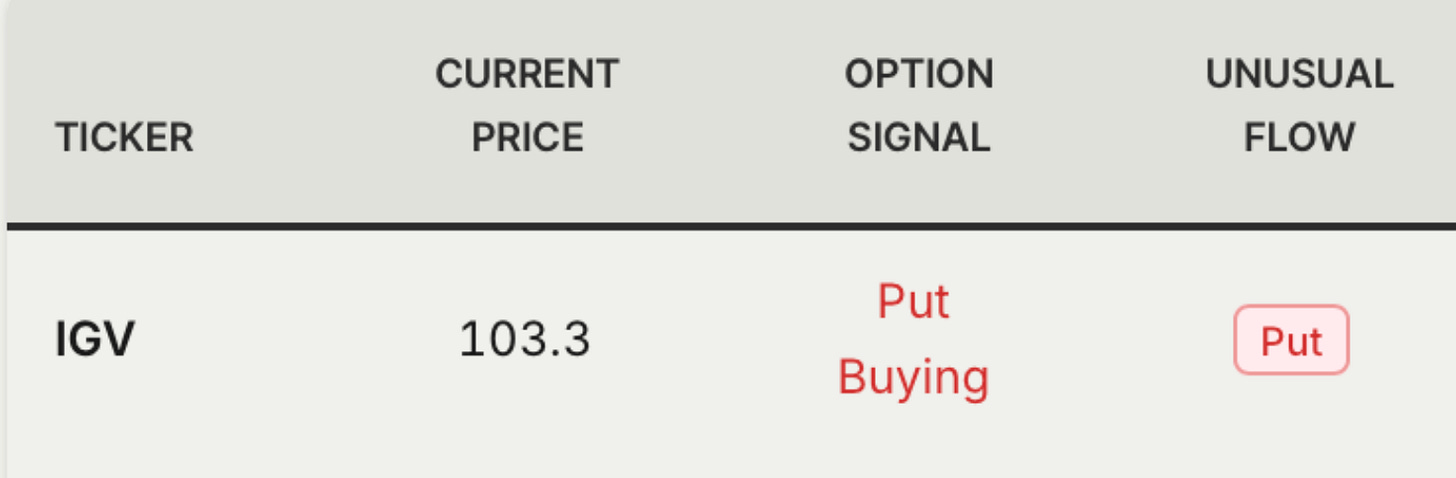

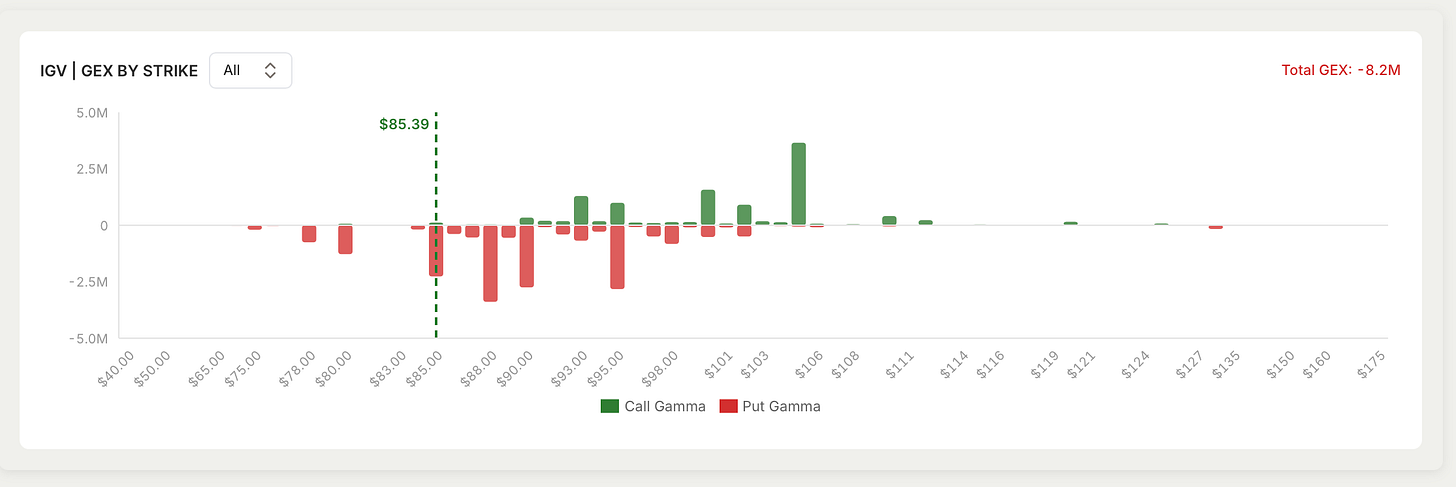

Software stocks are dragging down market breadth right now. This is causing choppy trading as people move money into steadier areas to avoid the current mess. Luckily, we spotted heavy betting against software IGV 0.00%↑ early on, which gave us the head start we needed to shift into outperforming sectors.

Screenshot as of January 14th

Even though software looks "cheap" on paper, we'd rather avoid the falling knives. Right now, the play is to chase the momentum where big buyers are showing up, rather than guessing at a bottom while positioning remains bearish.

The Fed is in the dark right now because of the data delays, but the “unusual flow” isn’t stopping.

Major market moves are brewing, and the signals are flashing “go.” We’ve just uncovered a fresh set of ETFs and high-growth names that are officially entering explosive Stage 2 breakouts, the kind of momentum you don’t want to be late for.

Alongside these opportunities, we’re doing a high-stakes deep dive into AMZN’s earnings and revealing the technical data that makes PLTR one of our top short convictions right now.

Let’s begin!