Market Prep: Tech Stocks & Volatility

$SPX $SPY $QQQ Trading Levels

Hello Traders,

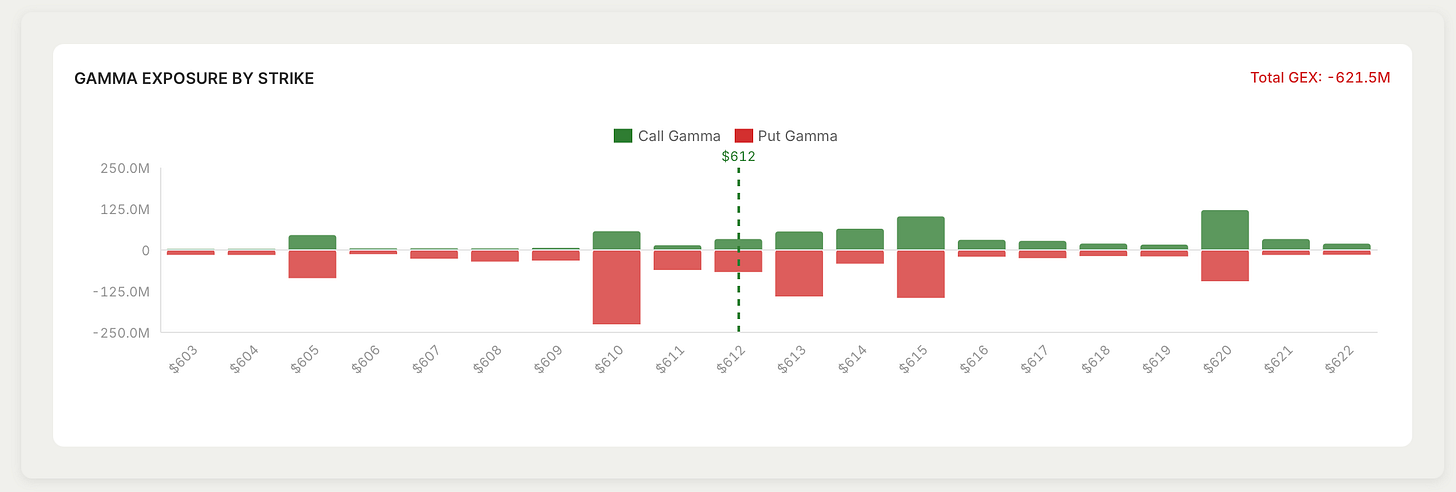

Today’s session was marked by contained volatility, despite some pressure in big tech. AVGO spent the day digesting its earnings, down another 5%+ and ORCL pushed to new lows on renewed AI demand concerns. This weakness is reflected in negative GEX on QQQ, showing dealers positioned in a way that can amplify downward moves if momentum builds.

QQQ Nasdaq ETF

QQQ GEX shows increasing put gamma around the $610 cluster, which is exactly where spot is trading. When price sits on a large put-gamma level and volatility remains low, this area tends to act as support, keeping price pinned and moves contained.

If volatility starts to rise, however, dealer hedging can flip.