Market Pulse: Powell's Dovish Jobs Jolt, JPM's $1.5T America First Bet, and ASML's Chip Earnings Spotlight

Hello everyone,

The $SPX didn’t manage to hold above the 20-day MA, and we closed below it again. That’s not very bullish, and we’re clearly in chop mode now. The 50-day MA is below us and is now acting as support. We didn’t manage to close above yesterday’s resistance at 6,658. For the SPX, another level of interest is 6,592, and then 6,540 as lower support levels. The market is in chop, so we have to exercise caution. This is a scalping environment, and it’s difficult for swing trading. Therefore, we advise against opening too many swing trades—you’ll get chopped around and lose hard-earned money.

Key SPX Levels to Watch:

Resistance: 6,658 / 6,677

Support: 6,592 (next interest level), then 6,540 (stronger floor).

When it comes to investing, it’s always good to have some cash on a side especially in environment like this, or hedge with collars, short calls, or assets that perform well in market drawdowns.

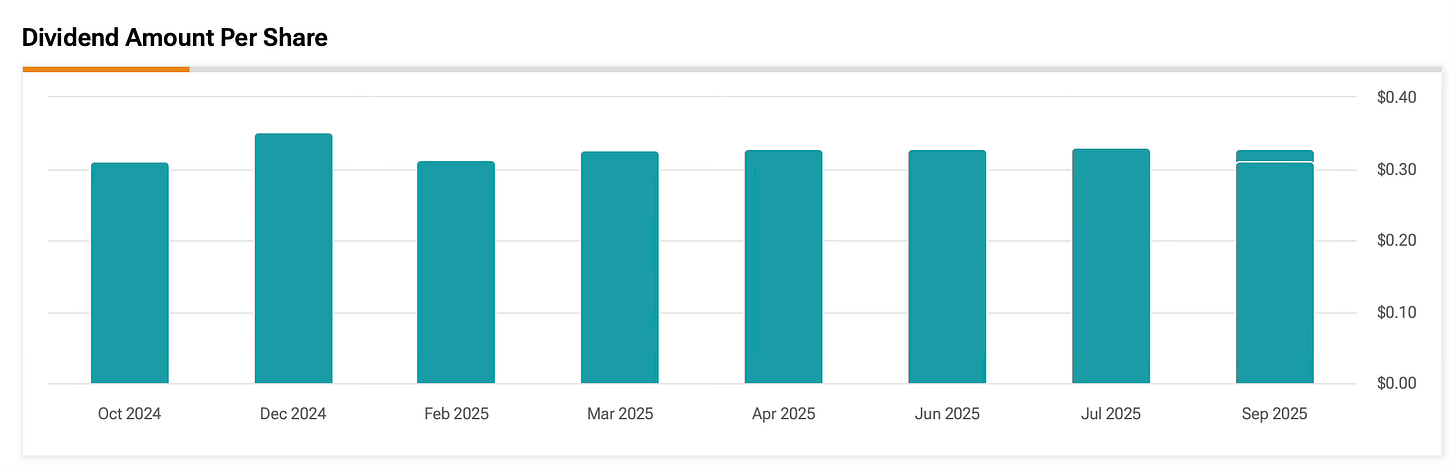

Our hedge position is the March $90 calls (90C) on TLT, which we’ve held open since last week. We also own the ETF. If you’re new here, we still think this looks pretty good for more upside. TLT isn’t a fast mover, but you get nice monthly payments when you own the shares and it’s a stabler asset. If you’re sitting on cash and want to park it somewhere or make your portfolio less volatile, it’s a solid option. (See dividend amount per share below).

Chip Earnings: ASML Tomorrow

Tomorrow’s (Oct 15) $ASML earnings report is the big one—holding a monopoly on EUV lithography machines key for advanced chips like Nvidia’s. Shares are up almost 40% in the past month (Europe’s top stock!), but expectations are high.

Looking at option flow with Quant Data, we see a lot of implied volatility into the $1200 calls.

ASML Q3 Expectations (Oct 15, Pre-Market):

EPS: $6.37 (+10.6% YoY); Revenue: €7.5B (+10% YoY).

Key Focus: AI-driven EUV orders expected up 30% for 2025. Installed base sales might hit €2.1B. Analysts (e.g., Morgan Stanley) predict a beat with price targets rising to $1,200 (from $1,000).

Risks: China export limits (20% of sales) or Intel fab delays.

Why It Matters: A strong report could boost chip stocks 5–10%; a miss (rare, with 8 straight beats) might dampen AI excitement.

SMR - Nuclear Stocks were again on a Tear.