Special Report: The IEEPA Cliffhanger: Everything You Need to Know Ahead of Tomorrow’s Historic Ruling

Hi Traders,

We will send you the weekly commodities report tomorrow morning. Tonight, we’re going to look at possible market scenarios for tomorrow’s Supreme Court ruling on one of the most consequential trade cases in modern American history: the constitutionality of using the International Emergency Economic Powers Act (IEEPA) to impose broad, peacetime tariffs.

At its core, this case isn’t just about trade—it is a high-stakes battle over the Separation of Powers. The Court must decide if the Executive Branch has overstepped its bounds or if the President maintains the necessary flexibility to defend the nation against modern economic threats.

It looks bleak for President Trump on prediction markets. But we want to look to more details on potential scenarios and what sectors/ stocks will benefit in each of those.

Let’s begin!

The Constitutional Tug-of-War

The legal foundation of this case rests on a direct conflict between two pillars of American law. On one side stands Article I, Section 8 of the Constitution, which explicitly grants Congress the power to levy tariffs and regulate foreign commerce. On the other stands IEEPA (1977), a statute that allows the President to “regulate or prohibit” foreign transactions during declared national emergencies.

The Government’s Position

The administration contends that tariffs are not merely a “tax,” but a vital regulatory tool. From their perspective, these duties fall squarely within IEEPA’s emergency powers. Their argument leans heavily on a history of “National Security Deference,” suggesting that the Executive requires rapid response capabilities that a deliberate Congressional body simply cannot match. They cite historical precedents like the Yoshida case to show that presidents have long restricted trade under emergency authority.

The Challengers’ Position

Opponents, however, argue that this is a case of unconstitutional overreach. They claim that IEEPA was never intended to authorize general, broad-based tariff policies. By bypassing Congress, they argue, the Executive is violating the Nondelegation Doctrine and the Major Questions Doctrine—the principle that major economic measures require explicit, clear authorization from the legislative branch. The risk, they warn, is “Unchecked Power,” where any future president could unilaterally impose duties at will.

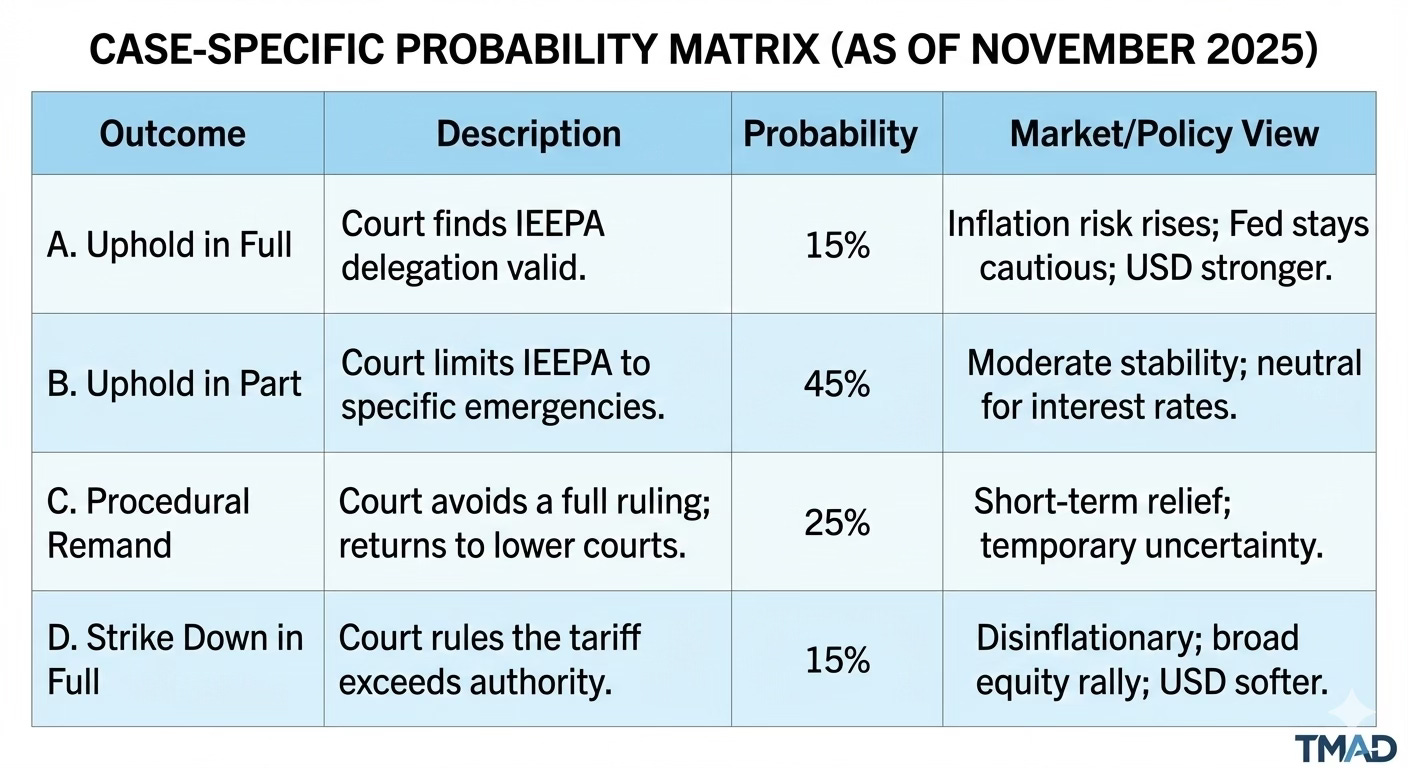

The Probability Matrix: Four Possible Outcomes

Market analysts have spent months modeling the four most likely scenarios for tomorrow’s ruling.

The “Narrow Ruling” (Outcome B) remains the base case. The Court often prefers to avoid sweeping constitutional changes, instead choosing to maintain the statute while significantly narrowing its scope. However, Outcome C (Remand) is a strong wildcard. By returning the case for “clarification,” the Justices could signal limits on executive power without causing an immediate systemic shock.

Market Implications & Positioning

Traders are already adjusting portfolios for the “Decision Window.” Here are some sectors and stocks that we’re paying attention to based on the outcome: