SPX Uptrend & VKTX Earnings, GSAT, ADBE in Focus

$VKTX $ADBE $GSAT

Hi Traders,

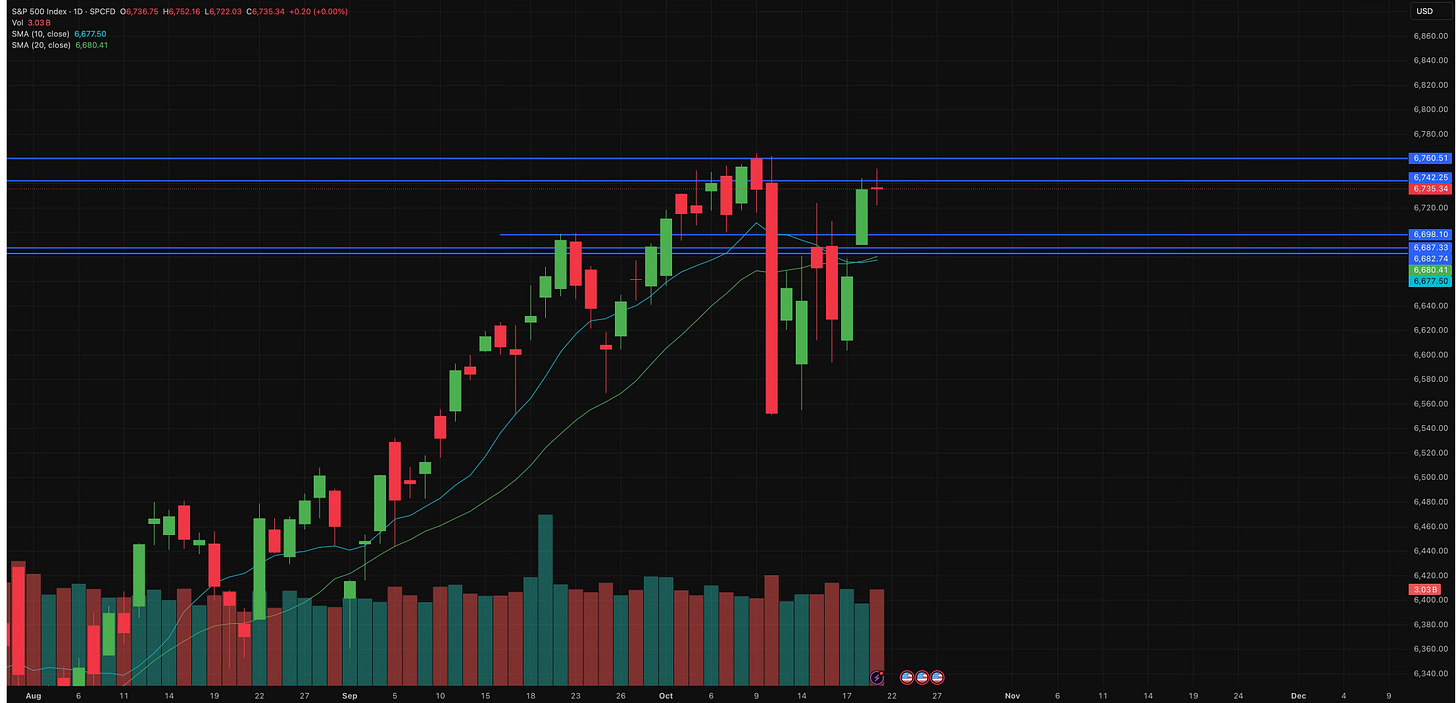

$SPX Technical Analysis Update

The S&P 500 $SPX has resumed an uptrend above 10/20DMA following a breakout yesterday. On Friday, the index experienced a strong upward move, and on Monday, it broke through a cluster of resistance levels at 6,682, 6,687, and 6,698.

Today, the market has been choppy, with the index consolidating below the 6,742 resistance level, taking a breather after two days of strong gains and momentum. The current resistance stands at 6,742, with the next levels to watch being 6,760 and 6,800, where further gains are possible. If the index fails to hold, the levels around 6,682–6,698 will provide strong support.

Tesla TSLA 0.00%↑ and Viking Therapeutics VKTX 0.00%↑ reports tomorrow. We’re providing a report on VKTX below, with NFLX and TSLA covered in yesterday’s letter. We will look into

GSAT 0.00%↑ , a sympathy play of ASTS 0.00%↑ that’s showing more promising setup and room to go higher.

We’re also observing a rotation from small-cap to large-cap stocks, a common market cycle. Individual stocks follow their own cycles as well, so it’s critical to stay mindful of these patterns. Beaten-down names like Adobe ADBE 0.00%↑ (see report below), Salesforce CRM 0.00%↑ and United Parcel Service UPS 0.00%↑ are gaining attention, while some overbought, overstretched stocks are experiencing sell-offs.

Quantum Computing: A Pause, Not the End

Is this the end of the quantum computing rally? No, but after some stocks surged by as much as 3,000%+ in a year, it may take time for the sector to regain momentum or sustain further gains. Rational trading is key—avoid chasing parabolic moves and ideally wait for retest on a wave 2 or 4 of Elliott wave cycle. You don’t want to get trapped at the end of the run or in a stock entering stage 4 markdown. Then you’ll be buying the dip that will keep dipping, so the best strategy is to set strict stops on those setups. We try to make your life easier and provide levels so you see the best place to set your stops.

GOOGL 0.00%↑ experienced a brief dip today but has rebounded, successfully retesting its trendline breakout and we’re back at our demand zone.

ADBE - Largest % Increase Since April - Gamma Wall much Higher

ADBE is flying today and if you’re not in this one, there’s a potential to play the