Using the TMAD Finance Newsletter Effectively

Educational Content

Hi everyone,

Many of you asked how to use the newsletter, so we created a video for you and here’s a dissection of the video. Our finance newsletter is coming out in an hour.

Key Steps

Understanding the Newsletter Structure 0:31

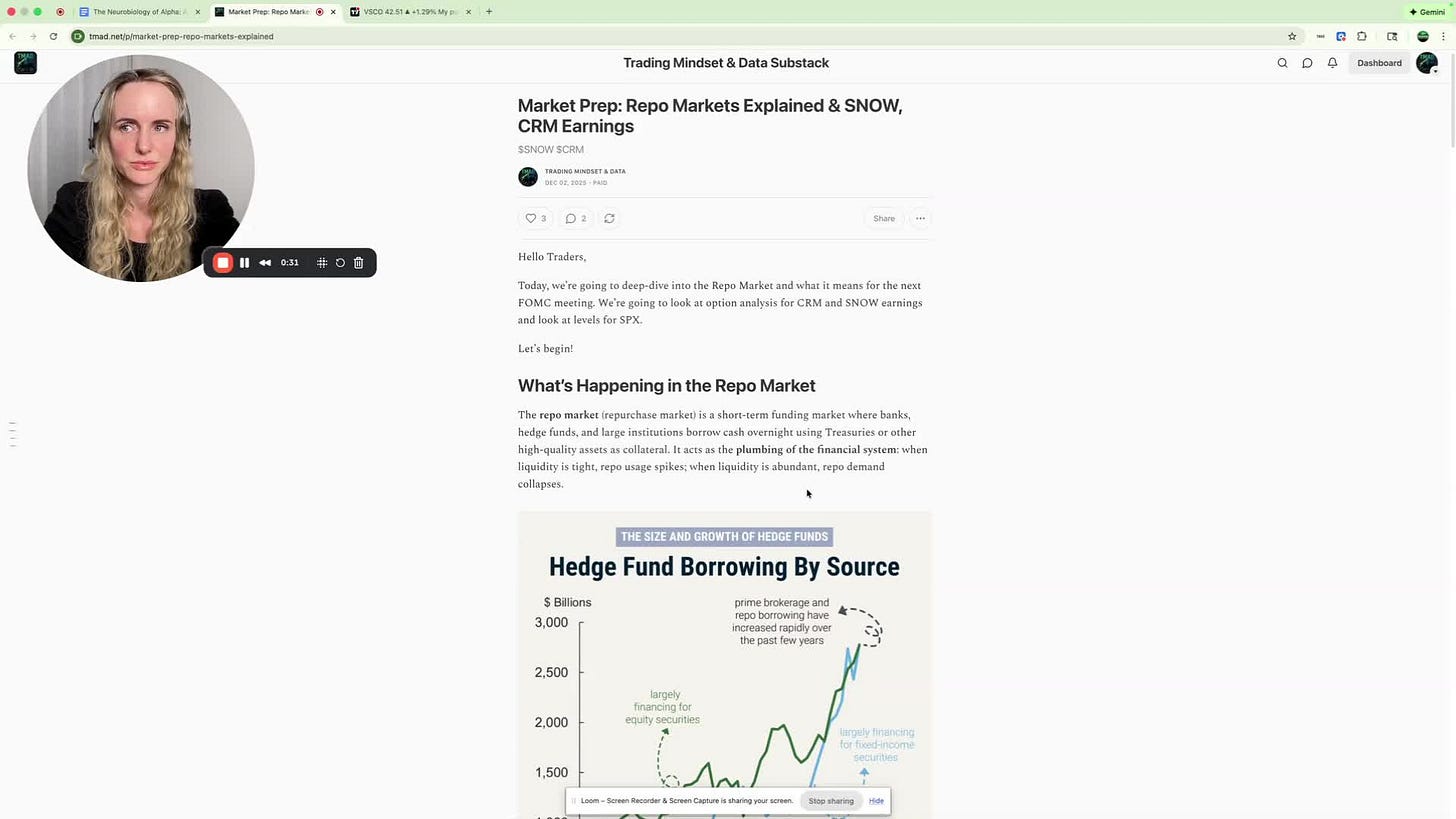

The newsletter begins with educational content relevant to current market conditions.

Focus on liquidity issues and other signific…