Market Prep: What's Causing the Mega Caps Weakness?

RCAT, Defense and JPM Earnings

Lot of people are asking us, why mega caps and software or other tech names are doing so poorly? Well, the answer is large funds coverings.

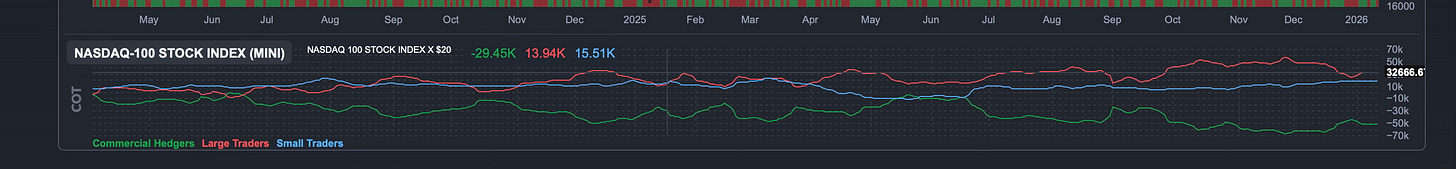

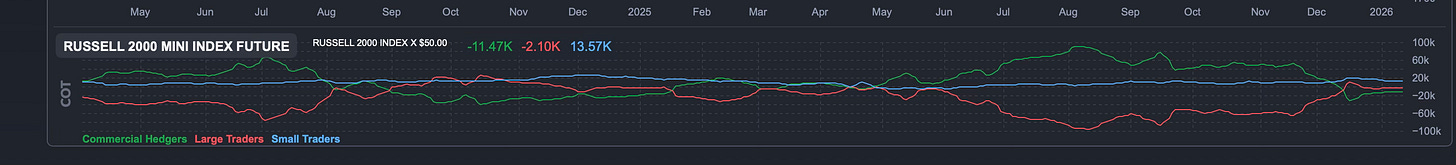

The recent volatility in tech and mega-cap “high fliers” isn’t a random occurrence—it’s the result of a massive squeeze in the small-cap space. As shown in the Commitment of Traders (COT) data, large funds have been heavily short on small caps (Russell 2000) since May. When small caps began to rally, these funds were caught on the wrong side of the trade and forced to cover their losses in mid-December.

To fund these massive short-coverings, institutions did what they always do: they sold what was profitable. They began offloading winners in the Nasdaq-100 and tech sectors to raise cash. This “sell the winners to pay for the losers” dynamic is exactly why many of the year’s top-performing stocks have suddenly hit a wall despite no change in their underlying fundamentals.

Please see those two graphics below. You can clearly see the red line, large funds, being heavily long on NASDAQ and short on IWM from approximately June.

With a drastic drop on tech around mid December and sharp increase on IWM, which means they are covering the short IWM losses with profits from tech. Nothing fundamentally changed in big tech. This is a simple market dynamic.

JPM Earnings: A Warning Shot for the Banking Sector

JPMorgan Chase JPM 0.00%↑ kicked off bank earnings this week, and despite beating analyst estimates on both the top and bottom lines, the stock tumbled over 4%. CEO Jamie Dimon set a somber tone, cautioning that markets may be underestimating risks like sticky inflation and geopolitical instability.

The sector is facing a “double whammy” of headwinds:

The 10% Rate Cap Proposal: Donald Trump’s recent proposal to cap credit card interest rates at 10% has sent shockwaves through the industry. Lenders warn this would devastate profitability and force them to slash credit availability for millions of Americans.

Rising Credit Losses: Banks are already seeing a tick-up in net charge-offs. JPM, for instance, had to set aside a $2.2 billion reserve related to the Apple credit card portfolio.

With other major banks reporting this week, Dimon’s “fortress” warning suggests we may see similar cautious outlooks across the board.

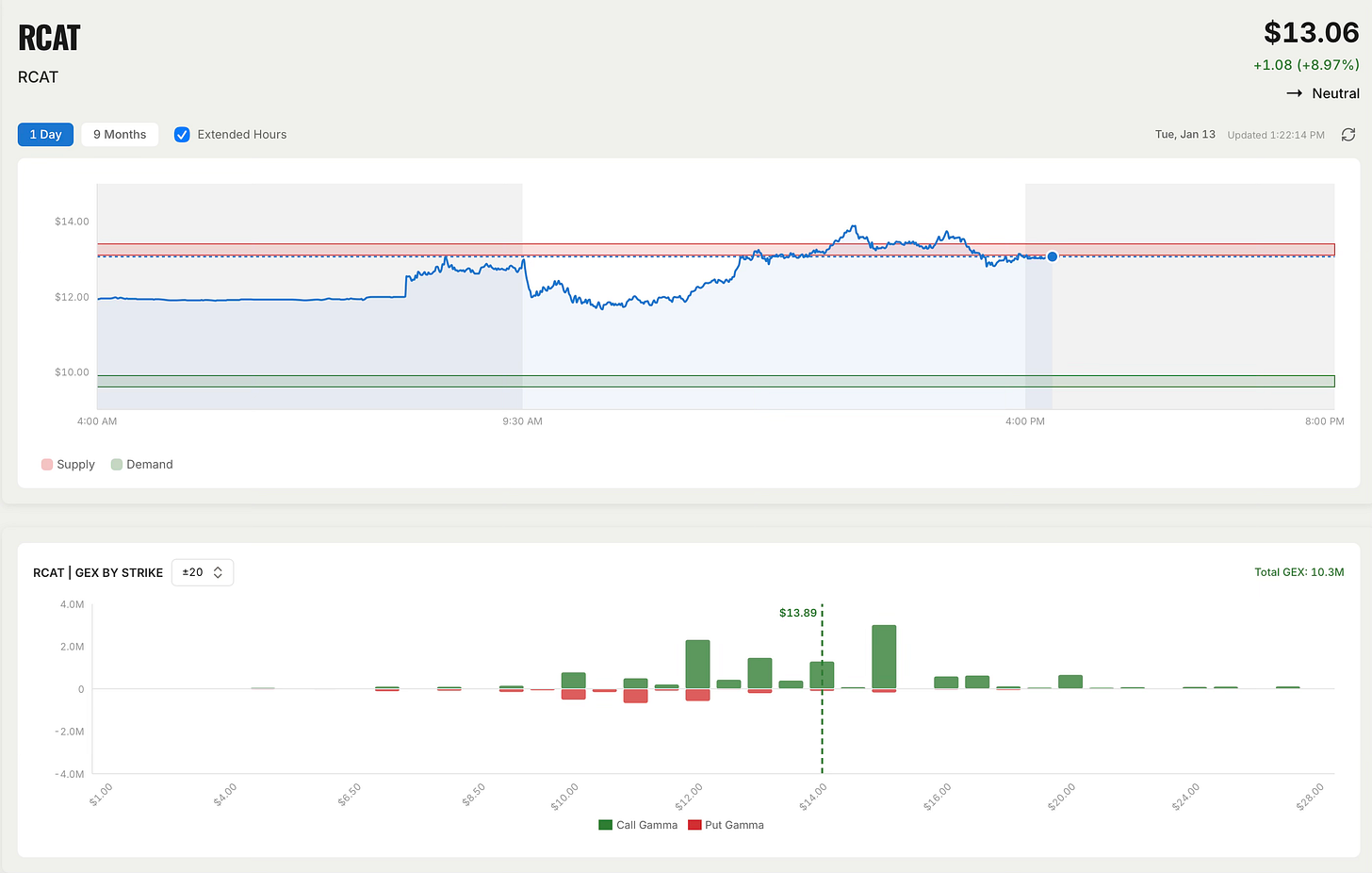

RCAT: All Eyes on the Needham Conference

We gave you this setup last week. It’s a name we’ve been eyeing and trading also last year.

Red Cat Holdings RCAT 0.00%↑ is showing massive relative strength, up nearly 10% today. The company has been aggressively raising its revenue expectations, and the momentum is building ahead of their presentation at the Needham Growth Conference tomorrow at 11:00 AM ET.

Here is why the setup is looking explosive:

Analyst Upgrades: Needham just raised its price target to $16 this morning, signaling significant upside from current levels.

The Short Squeeze Factor: Short interest remains high at approximately 21 million shares. With the stock trending higher, these shorts are increasingly under pressure.

The Key Level: There is currently a significant sell wall between $13 and $13.49. $RCAT broke through and hold above this level on close. This could clear the path for a major run.

Keep a close eye on the news coming out of the conference tomorrow morning; it could be the catalyst needed to break that wall.

Seeing our scanner, GEX is 15 and 16 as major levels where the stock price could be drawn to. Also see top graph, and see how the stock struggled with the supply (red line). It broke out above and closed right on it. Fingers crossed to all of us, holding. If we have positive news, and stock goes strongly above $13.50 supply, there is a nice entry as well, targeting $16 and higher.

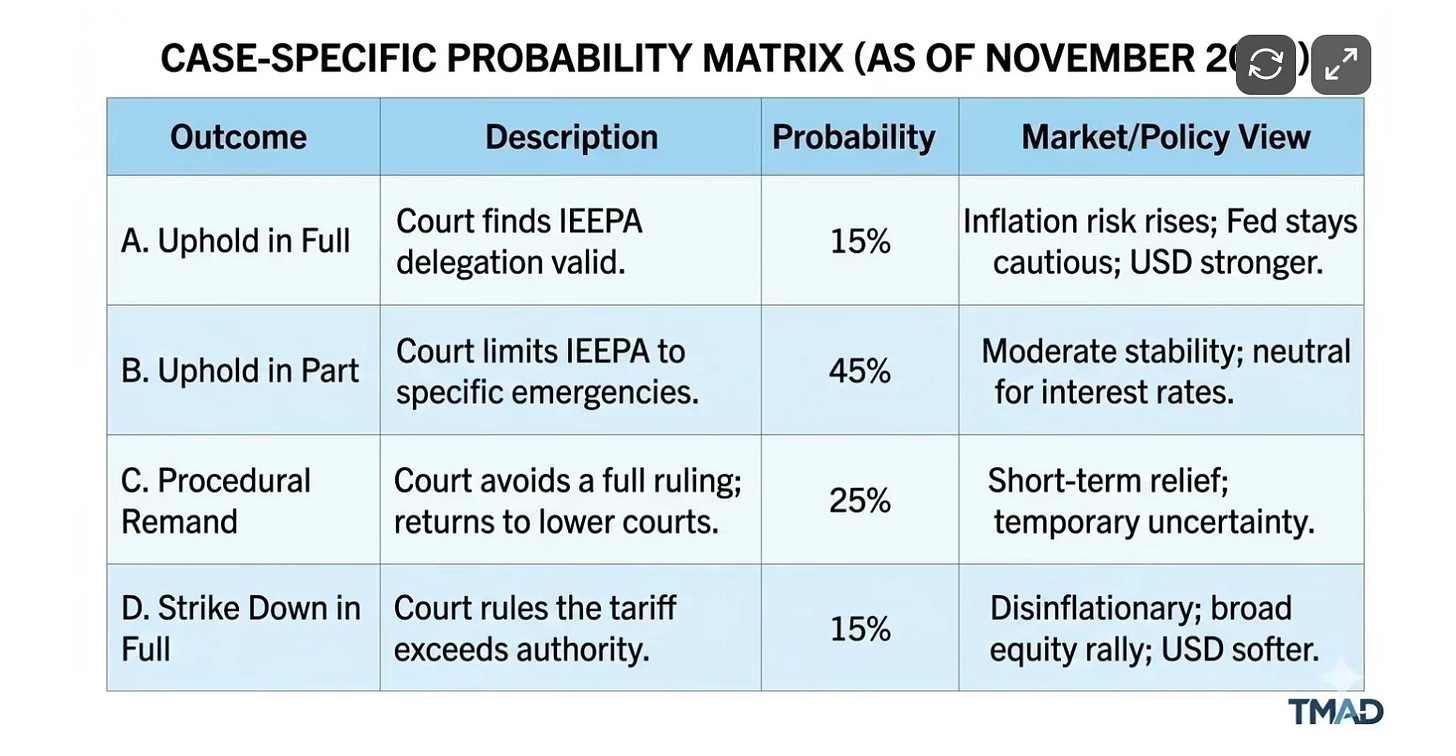

Tomorrow we have Supreme Court ruling on Trump and tariffs. Here are 4 potential outcomes of the ruling and its effect. Please read more in our last week’s article:

Trade Ideas:

We want to be cautious due to the Supreme Court ruling tomorrow, but these are the names we’re putting on our watchlist with great technicals and chance of nice movement.